Ecopro VS POSCO

South Korea’s two pillars of secondary batteries.

Both companies were groups that heated up the first half of 2023.

But if you have to invest in only one, where should you invest?

Stocks are made up of so many elements such as the value of the company, the soundness of the business, the value of the future, and so on.

You must make a careful judgment.

It is too difficult to compare the various complex factors one by one.

In such times, we should make simple judgments based on accessible and straightforward information.

I have organized the future expected sales and current public sentiment.

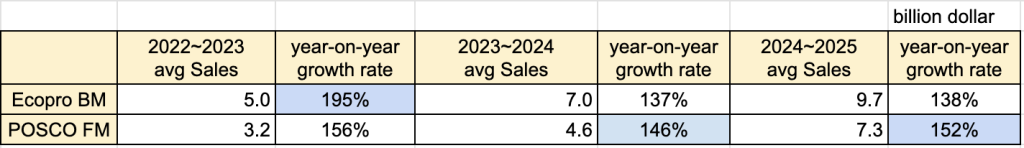

Ecopro VS POSCO: Future Sales Comparison

To be precise, I intend to compare Ecopro BM and POSCO Future M.

Ecopro and POSCO Holdings are too large, and cathode materials have the best profit margin.

Excluding the first half of 2023, the subsequent sales are the company’s estimates. However, the company’s estimates can be seen as a measure of their ability and confidence.

Also, the previous year’s sales and the current year’s sales influence investment sentiment, so I’ve distinguished them by taking the average of two years.

It’s true that Ecopro BM has experienced rapid growth through 2022 to 2023, but it’s expected to see a continuous decrease after 2024, with an anticipated growth rate of about 130%.

However, POSCO Holdings is expecting a growth rate of around 150%.

If all conditions remain the same and this trend continues, by the year 2028, POSCO Future M might be able to catch up with the sales of Ecopro BM.

Moreover, POSCO Future M has acquired the Hombre Muerto salt flats in Argentina and is making efforts towards vertical integration.

In addition, it was mentioned that “Ecopro is currently achieving good performance with high results,” and that “in the future, POSCO Holdings is expected to become the only company in the world to complete a full value chain that can supply everything from mines to raw materials, and both cathode and anode materials in the secondary battery materials sector.”

The currently anticipated growth rates of 130% and 150% could turn out to be even more divergent.

Ecopro VS POSCO: Investor Sentiment Comparison

The price of stocks is not determined solely by a company’s sales.

There must be investor sentiment, and this sentiment needs to create trading volume.

What indicators can we look at to gauge sentiment?

It’s ‘search’.

This was verified through the ‘News-based Statistical Search’ by the Statistics Office.

These are the associated search keywords that people look up when they search for batteries.

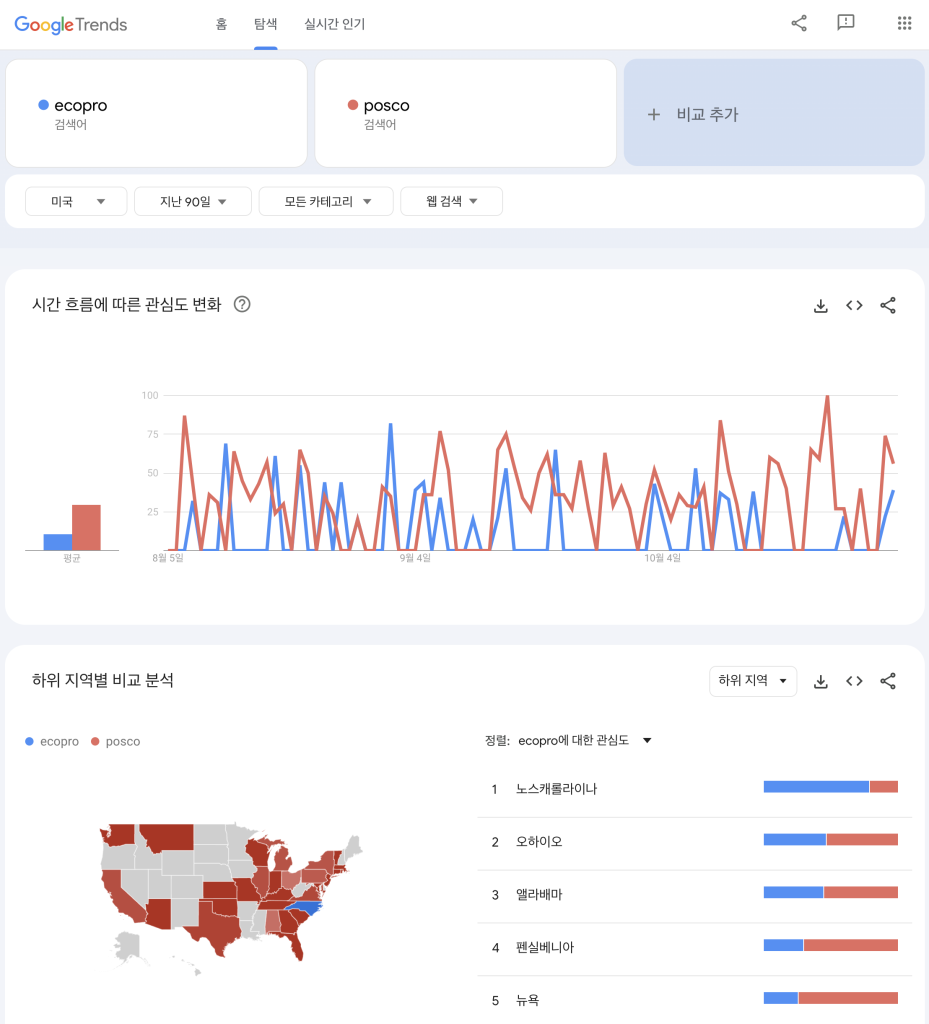

I compared the search volumes for the two companies in the United States using Google Trends.(last 90days)

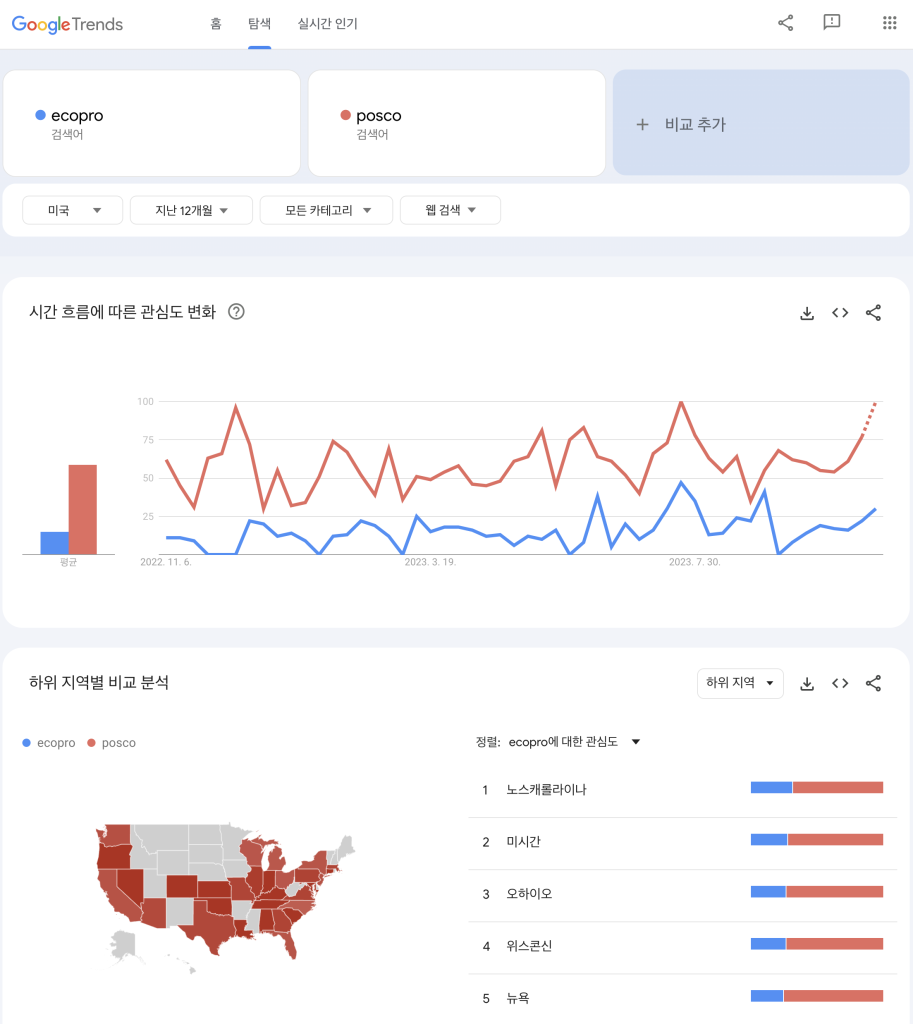

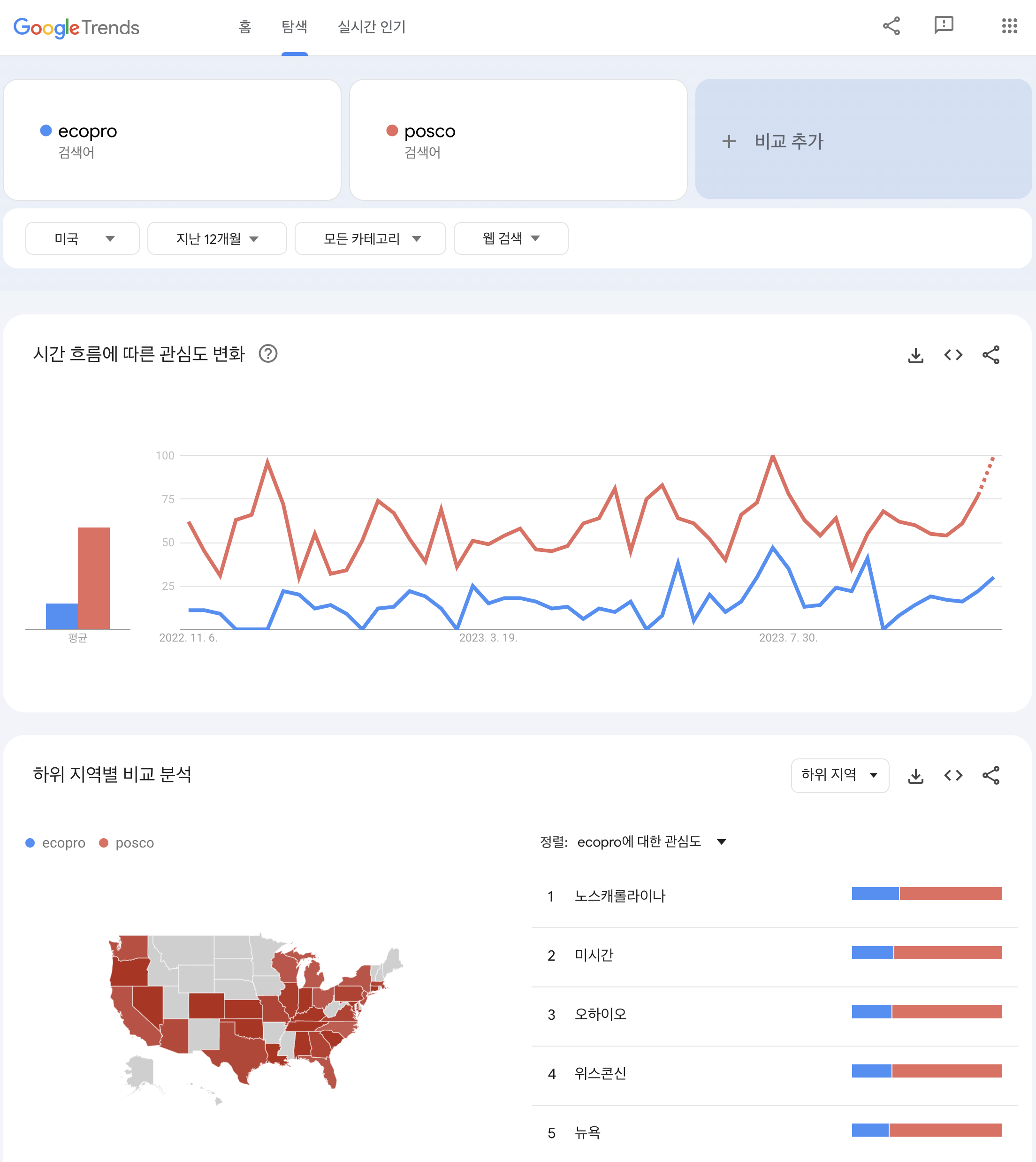

last 12 months.

Throughout the year, the search volume for POSCO in the United States has been higher than that for Ecopro.

Ecopro VS POSCO: In Summary.

The secondary battery market is expected to continue growing with a CAGR (Compound Annual Growth Rate) of around 15%. Within this market, the cathode material sector is expected to grow by about 400% over the next 10 years.

Of course, this is an overall average value, so some companies may grow by 20%, while others by 10%. By considering the potential for greater growth and future expected sales, one can infer the business outlook of a company.

Furthermore, investor sentiment can be gauged through search results. Although there was no significant difference, it was evident that POSCO Future M, which had relatively fewer issues, still has a considerable psychological impact.

By synthesizing this data, it seems important to invest in a cathode material company with promising prospects.

Recommended on the website

Investing in the Future #1 | Finding the Secondary Battery Investment Sector

EcoPro, Panasonic Holdings, CATL: Battery Company Comparison

Battery man | Is the secondary battery industry in South Korea truly promising?(Denmark Battery man)

A person essentially help to make severely articles I might state.

That is the first time I frequented your web page and

so far? I surprised with the analysis you made to make this actual submit incredible.

Fantastic job!