Secondary Battery Outlook

The secondary battery is both the future and the reality. Even now, electric vehicles are roaming the roads. In the future, there will be even more electric vehicles around.

It’s not just electric vehicles. The things we take for granted using electricity might be replaced by secondary batteries in the future, possibly adding mobility.

Many people talk about the outlook for secondary batteries in many books.

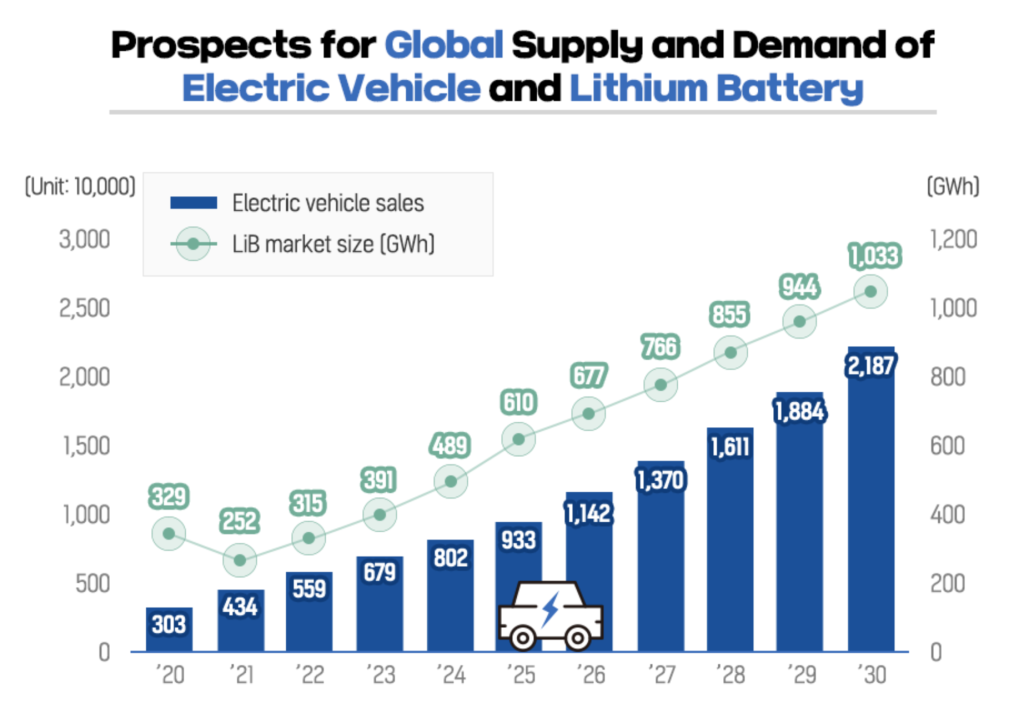

f we compare five years from now to the present, the secondary battery market will increase by 218%, and the sales of electric vehicles will increase by 237%.

Analysis of the Secondary Battery Sector

The secondary battery market in 2023 was dynamic. We have seen ups and downs in all related stocks for materials (cathode, anode, separator, electrolyte), components, and equipment.

Outlook for the Secondary Battery Sector by Sector

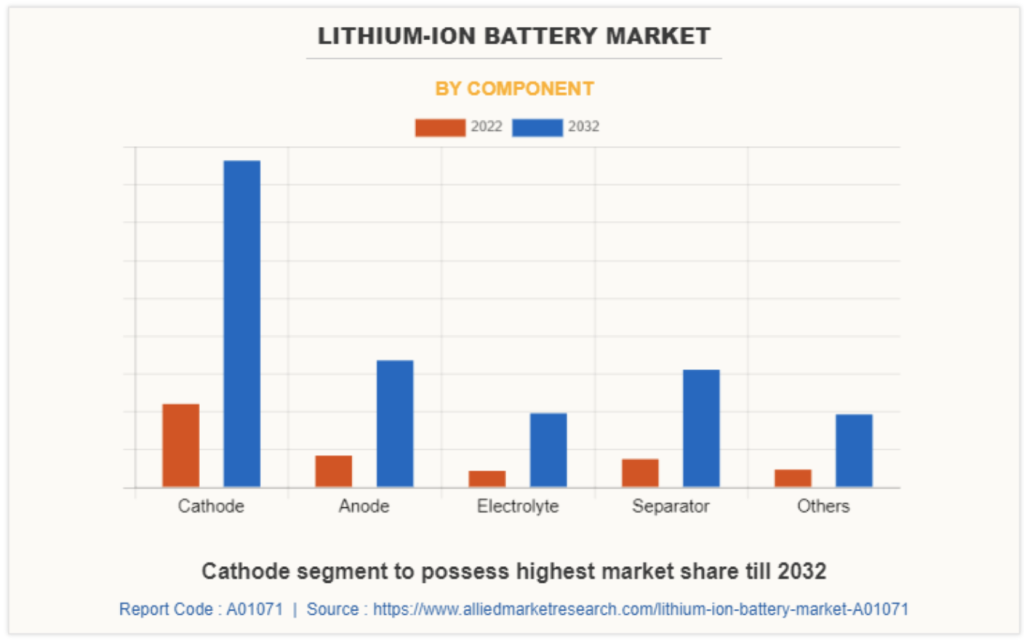

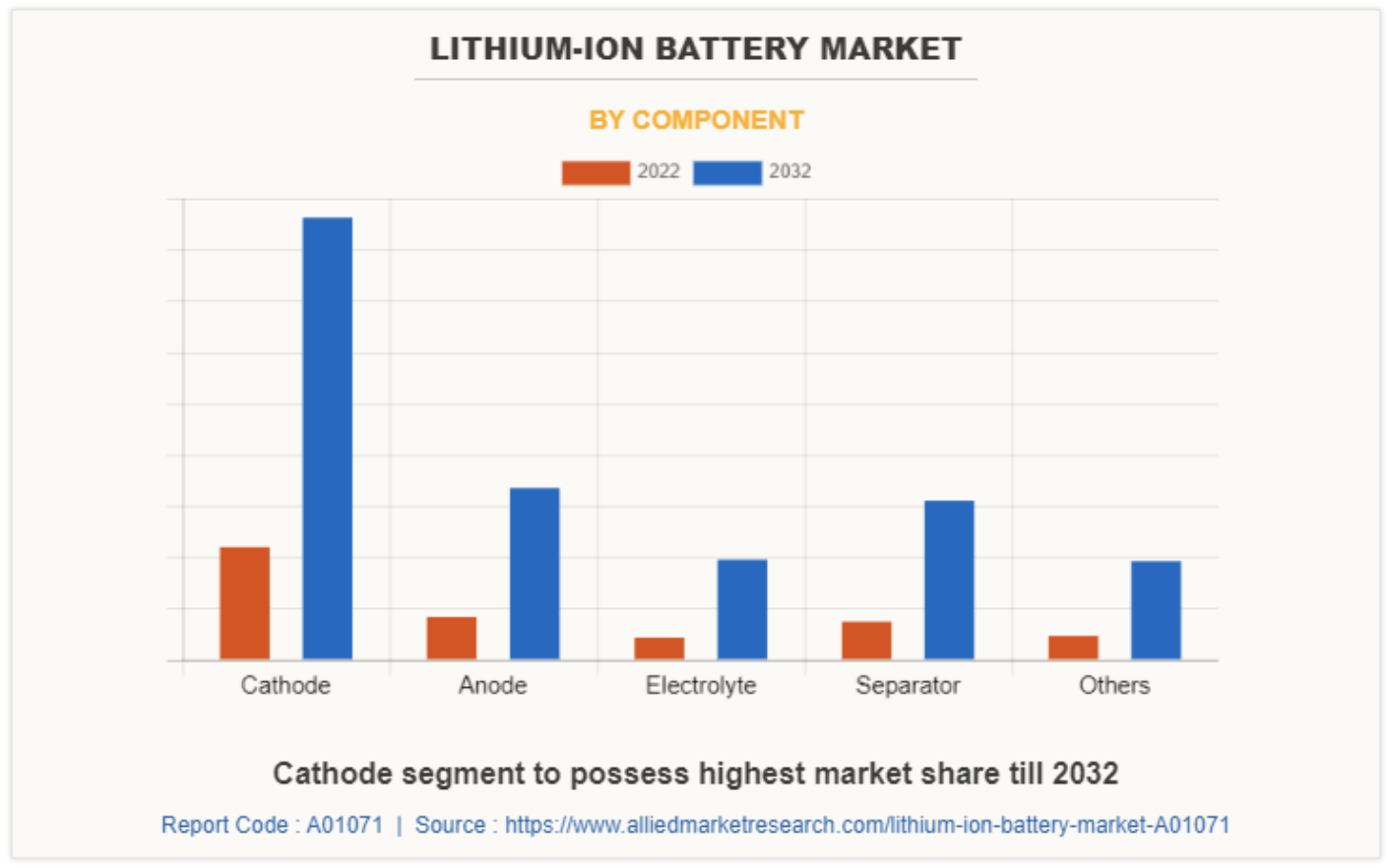

Looking at the sector-by-sector outlook, one can determine where to invest. Every sector appears better than it is now. The cathode sector looks particularly promising, but on closer inspection, other areas are also expected to grow significantly compared to the present.

Cathodes are expected to increase by about 400%, anodes by 350%, electrolytes by 450%, and separators by 350%.

Therefore, it naturally follows that investing in cathode and electrolyte companies would have a better outlook.

Secondary Battery Material Stocks

Cathode materials showed high profits due to their excellent operating margins. EcoPro’s stock price rose from the 110,000 won range at the beginning of the year to the highest of 1.5 million won. Since February, the trading volume exploded, and the stock price rose day by day.

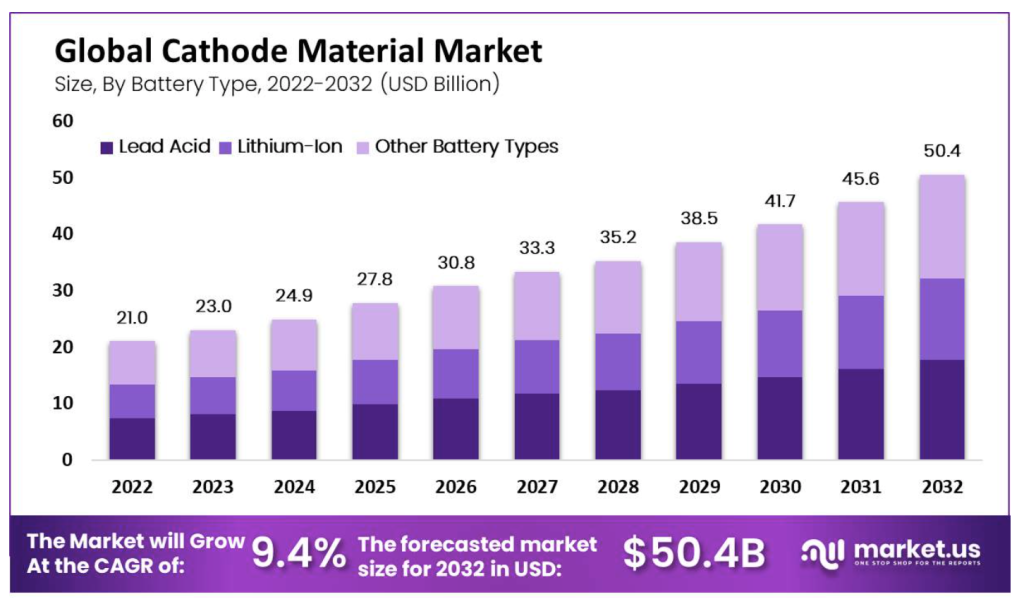

The CAGR (Compound Annual Growth Rate) for cathode materials is estimated at 9.4%. By 2028, it is expected to be valued at 33.3 billion dollars.

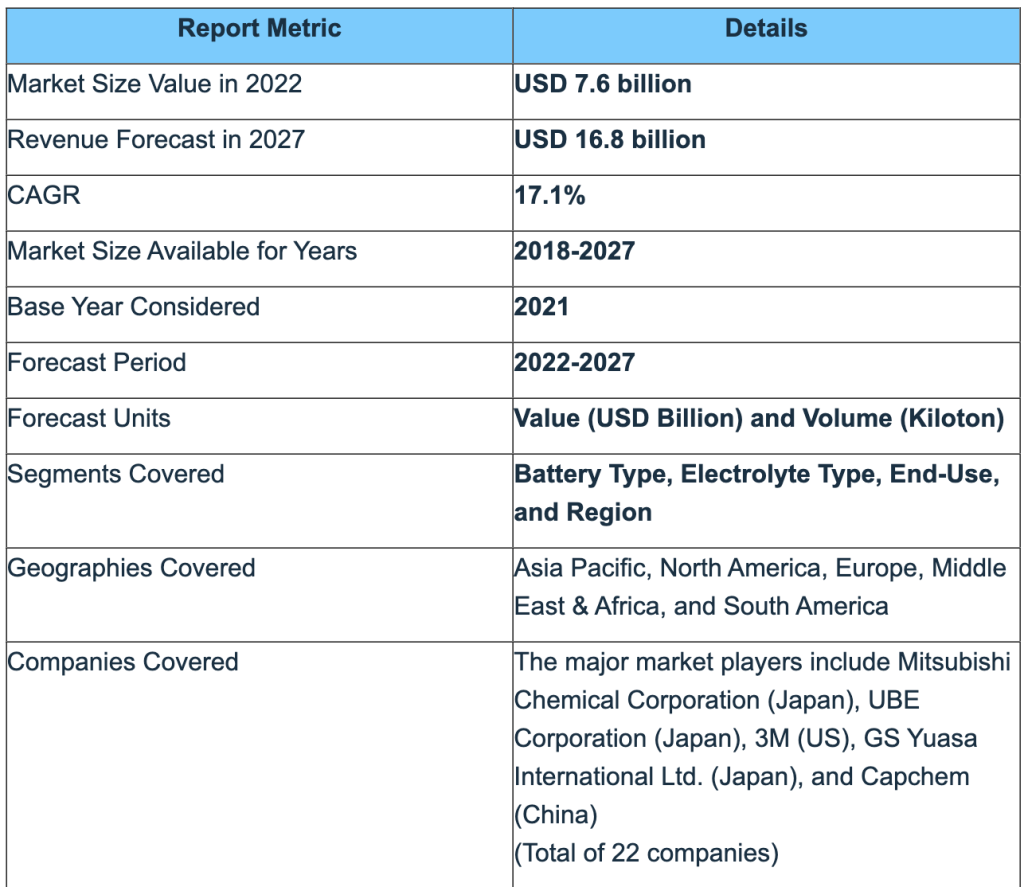

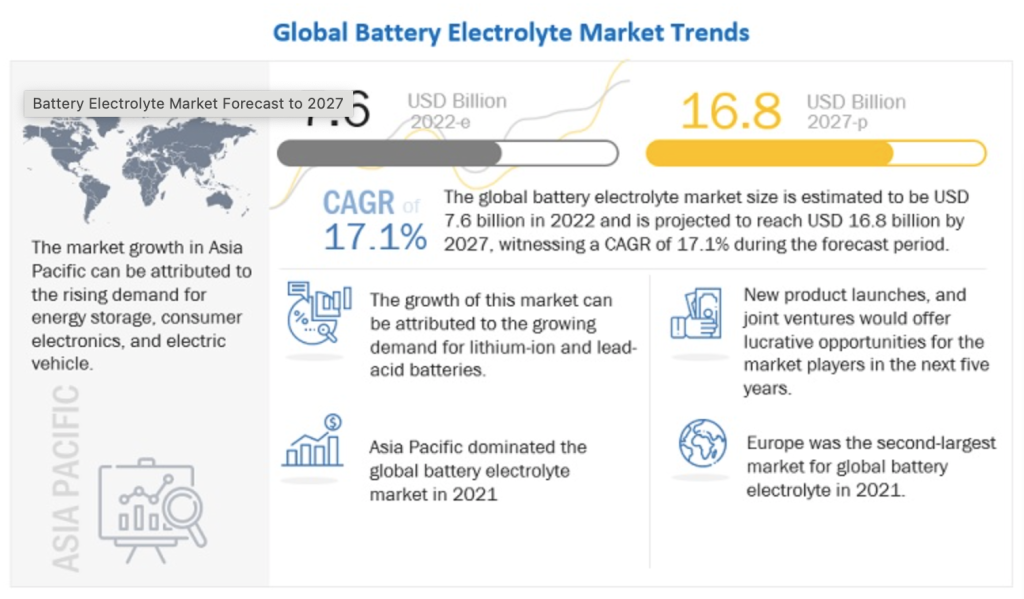

The electrolyte market is expected to grow at a CAGR of 17.1%, from 7.6 billion dollars in 2022 to 16.8 billion dollars by 2027.

Leading Secondary Battery Companies

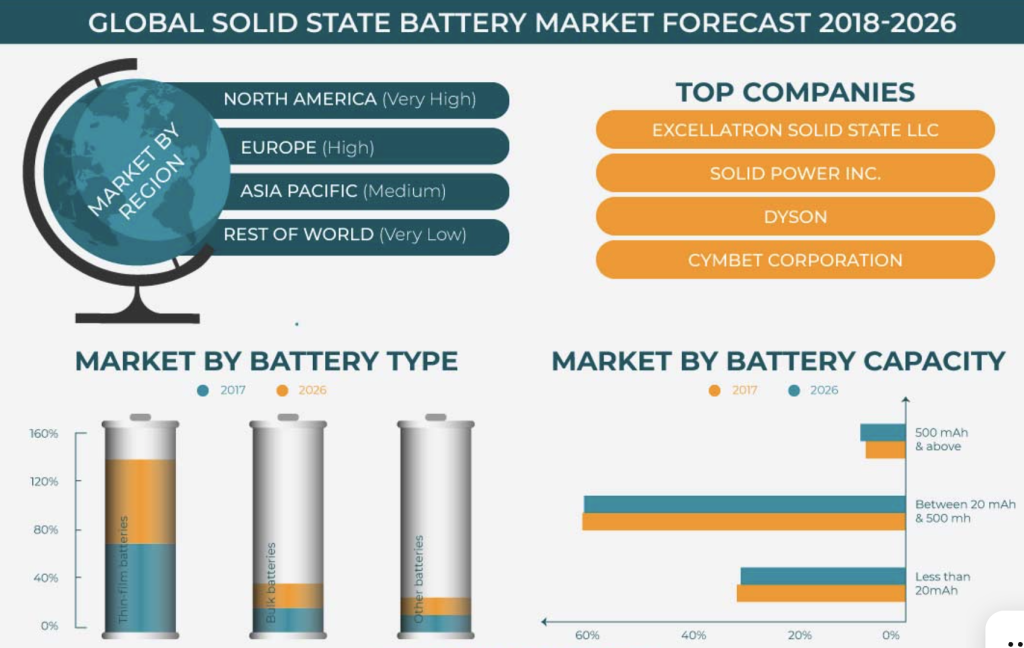

United States: QuantumScape, Microvast Holdings, Albemarle, Solid Power

In the US, Albemarle is almost the only company generating revenue related to secondary batteries. However, its performance is affected by the supply of lithium and is not stable.

South Korea: EcoPro, LG Energy Solution, EcoPro

Japan: Panasonic

The cathode technology of South Korea and Japan is already ahead of other countries, so they will continue to dominate the market in the future.

Recommended Reads on the Website

NIKOLA (TRE FCEV) VS TESLA (SEMI)

Principles of secondary battery and anode materials

High-nickel anode material and Ultra high-nickel anode material’s Justice and outlook

Having read this I thought it was extremely enlightening.

I appreciate you taking the time and energy to put this short article

together. I once again find myself personally spending way too much time

both reading and posting comments. But so what, it was

still worthwhile!

Simply desire to say your article is as astounding. The clarity for your put up is just great and that i

could suppose you are knowledgeable on this subject.

Fine with your permission allow me to clutch your RSS feed

to stay updated with drawing close post. Thanks

one million and please continue the enjoyable work.