Outlook of ARM Following its IPO.

With ARM going public, a new wind is blowing in the US stock market. Accordingly, we will take a look at the ‘outlook for ARM’ and the types of semiconductor companies.

ARM provides chip designs used in various platforms, including smartphones, tablets, servers, and embedded systems. It’s a company that Samsung Electronics pays over 200 billion a year in technology fees. ARM has continued to grow since being acquired by SoftBank. This growth is due to ongoing investments in the AI and machine learning sectors. It’s not just a company that produces hardware, but it’s shaping the future centered around AI technology.

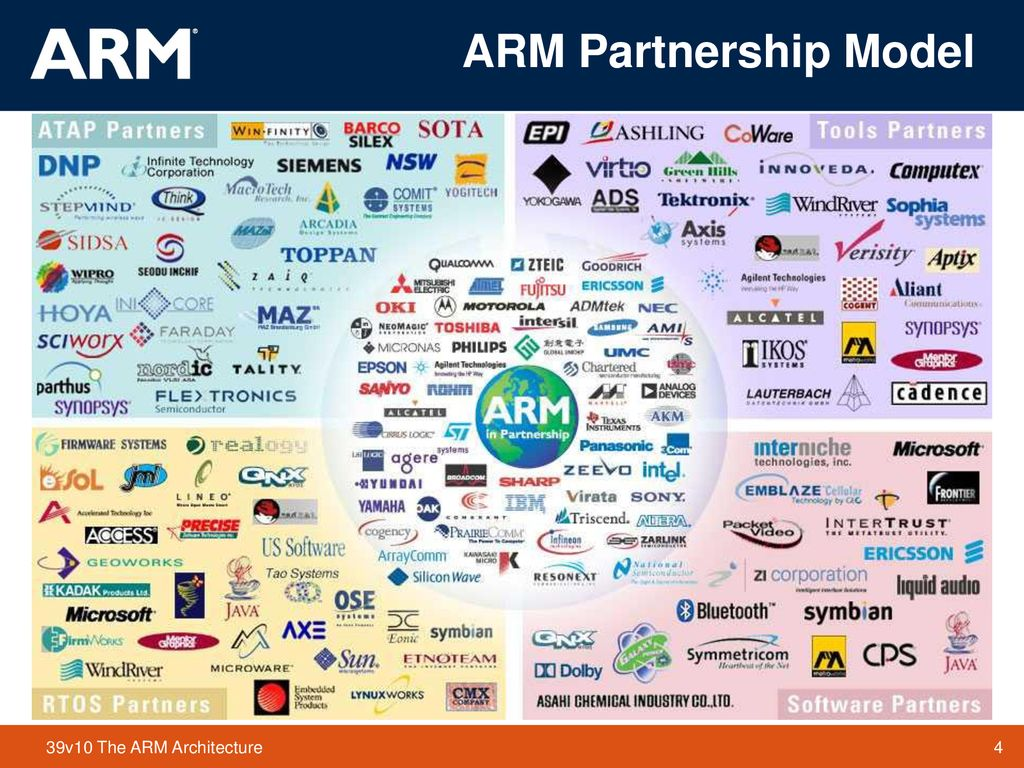

While Intel primarily produces hardware for computers, ARM produces hardware for low-power devices like smartphones. Known clients include Samsung, Apple, Qualcomm, Google, and Alibaba, with over 1000 known companies.

Before delving into the outlook for ARM, it’s necessary to understand the classifications of semiconductor companies. Semiconductor firms can be categorized in various ways based on the products they manufacture or design, their services, and their business models.

Classification of Semiconductor Companies.

Fabless

These companies focus solely on semiconductor design. They commission Foundry companies to manufacture the products they’ve designed. In terms of market share, the order goes Qualcomm, NVIDIA, Broadcom, MediaTek, and AMD.

Qualcomm, a U.S. firm, is the leading designer of semiconductors that dominate the AP market, the brain of smartphones. One of Qualcomm’s primary sources of revenue has been Apple. Even though Apple has ventured into designing its own AP, Qualcomm has been continuously growing by diversifying its business into areas such as autonomous driving, VR, and IoT. Recently, they acquired the Swedish automotive tech company Veoneer, indicating their significant move into the autonomous driving chip development.

NVIDIA, another U.S. company, is a powerhouse in the GPU (Graphics Processing Unit) market. While traditionally GPUs from NVIDIA were primarily used for video game graphics, their applications have broadened recently to areas such as autonomous vehicles, cryptocurrency mining, and data centers. Lately, their performance has been steadily improving in the gaming and data center sectors.

Broadcom, also based in the U.S., operates in semiconductor solutions and infrastructure software businesses. Within its fabless segment, they develop and sell chip solutions used in data centers, networks, set-top boxes, communication devices for smartphones, and base stations.

MediaTek, a Taiwanese firm, is a smartphone AP development company. While Qualcomm is recognized for producing high-end APs, MediaTek is known for producing mid-to-low end products, showcasing its strength in price competitiveness. Succeeding in targeting the mid-to-low end market, according to a report by Counterpoint Research, MediaTek surpassed Qualcomm with a 46% market share in the Android smartphone AP market in 2021, compared to Qualcomm’s 35%.

AMD, headquartered in the U.S., designs computer central processing units (CPUs) and graphics processing units (GPUs). In the CPU domain, it competes with Intel, and in the GPU domain, it competes with NVIDIA. According to market research firm Statista, as of the fourth quarter of 2021, the global market share for x86 computer CPUs was 60.7% for Intel and 39.2% for AMD. Gaming consoles like PlayStation and Xbox also utilize AMD’s chips.

Foundry

These companies solely manufacture semiconductors. They produce semiconductors on behalf of Fabless companies. Examples include TSMC and Samsung Electronics.

TSMC was established in 1987 in Taiwan. As the world’s first dedicated semiconductor foundry, it produces chip designs for various companies. A pioneer in advanced manufacturing processes, TSMC continuously invests in research and development. They possess cutting-edge process technology and have partnerships with most Fabless semiconductor companies, such as NVIDIA, Qualcomm, and AMD.

Samsung Electronics originally started as an IDM company but now also offers foundry services. It is one of the leaders in advanced manufacturing processes and competes with TSMC in possessing the latest semiconductor manufacturing technology.

IDM (Integrated Device Manufacturers)

These companies handle both design and manufacturing. Notable companies in this category include Intel, Samsung, and Texas Instruments.

Intel was founded in 1968 and its primary products include microprocessors, platform solutions, integrated circuits, and graphics cards. Intel has maintained a dominant position in the PC and server markets for a long time. Recently, it is expanding into new areas like AI, autonomous vehicles, data centers, and cloud computing.

Texas Instruments began in 1930 as a company producing equipment for oil exploration. It’s a leading manufacturer of analog semiconductor products. They perform basic electronic functions like power management, signal processing, and conversion. The company consistently invests in research and development. Having been active in the semiconductor market for a long time, their high-quality products have proven to be reliable.

Outlook of ARM

Outlook of ARM (Revenue)

Rene Haas, the CEO of ARM, has conveyed, “We expect steady growth, with revenue increasing by over 10% by 2026.” He also revealed that the adjusted operating profit margin for the 2023 fiscal year was 29% and that they plan to expand this to 40% in the first quarter. Moreover, they anticipate that the long-term operating margin will reach 60%, and the profit margin is expected to be about 65% of the revenue.

This information is ARM’s forecast. However, market forecasts might differ, and there is also a need to consider the sharp decline in smartphone shipments.

Outlook of ARM (Technology)

First, it’s essential to understand the ARM architecture. It is a RISC (Reduced Instruction Set Computer) processor that is widely used in embedded devices. Compared to Intel’s CPU series, which is CISC, it has a simpler instruction structure, allowing for low power and a simplified CPU instruction set. As a result, it is used as the CPU in various electronic devices, including iPhones and Galaxies.

As ARM architecture performance improves, more companies are expected to use the ARM architecture in PCs and servers in the future. The semiconductor market expert previously mentioned that, “When processors are made based on the ARM architecture, compatibility with mobile devices using the same structure will improve.” He also said, “Just as Apple could grow with high compatibility, other companies might also apply ARM architecture-based processors to not only mobiles but also PCs, servers, etc., aiming to enhance compatibility in the future.”

Outlook of ARM(Stock Price)

It’s necessary to understand the characteristics of IPO companies. Many participate in the initial IPO with the dream that it will become the NVIDIA of the future, which causes the stock to rise temporarily after the IPO. On average, they have shown a growth rate of 15.8% on the day of listing on the US NASDAQ.

However, while there’s a high probability that the stock price will rise on the day of listing, there’s no guarantee that it will be a good investment target afterward.

While ARM is indeed a commendable company, it has consistently been the subject of acquisition rumors, involving companies like NVIDIA and Samsung Electronics.

However, in the application form announced ahead of its listing, we can identify some negative information. The company was expected to report about a 1% decrease in sales for the fiscal year ending in March. Due to a sharp decline in global smartphone shipments, ARM’s revenue fell to approximately $2.68 billion.

The global demand for smartphone semiconductors is showing signs of decline. Naturally, as the global demand for smartphones wanes, the shipment volume of semiconductors also decreases. Qualcomm’s stock performance throughout the year also indicates continuing challenges. Due to these reasons, there seems to be insufficient justification for a significant rise in ARM’s stock at this point. While they claim to be conducting research related to AI and electric vehicles, it seems essential for the company to expand into these sectors and generate revenue.

Recommended on the Website

One thought on ““Outlook of ARM”(Feat. Types of Semiconductor Companies, ARM’s IPO)”Outlook of ARM””