AUTHOR

The Power of Reading 1% Author.

Pen name: Mer. He is South Korea’s top capital market analyst and an unparalleled power influencer in economics and the stock market, offering a unique perspective that is unmatched.

He predicted and measured various financial risks for global corporations such as Samsung and GE, as well as for financial institutions, corporations, and funds. He worked as a risk management expert, devising measures against these risks. He oversaw the development of financial products, the operation of risk management systems, and the approval of corporate finance proposals.

At four financial companies, he served as an executive, ultimately reviewing and approving more than 30 trillion won in domestic and foreign real estate investments, real estate PFs, corporate finance, NPL funds, and more. This is why not only individual investors but also corporate executives pay attention to his predictions and insights.

Without relying on such a track record, with just the articles he posts under his pen name at 12:10 AM daily, he created a blog with over 100,000 subscribers in just over a year. Every time he posts a new article, he breaks his own record for the most views.

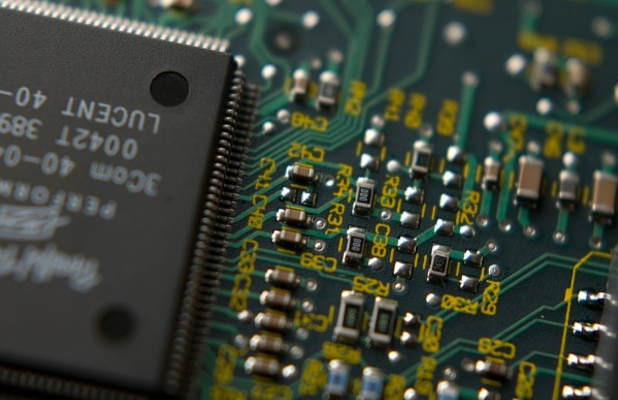

The Power of Reading 1% #1: Semiconductors, the Key to Dominant Nation Competition

TSMC, a semiconductor company from Taiwan, dominates the global foundry (contract manufacturing) market with a market share close to 60%. (A foundry is a company that solely produces semiconductors.)

One of the reasons for this is that they have major clients like Apple and NVIDIA and demonstrate a robust revenue structure. Specifically, Apple entrusts TSMC with the entire production of the application processors (AP) for iPhones, iPads, and MacBooks using the most advanced processes.

For now, TSMC is expected to lead the market. It’s been reported, “Following the mobile AP, the production for NVIDIA and AMD’s HPC CPUs and GPUs has begun using the 5-nanometer process, which has led to a continuous increase in TSMC’s 5-nanometer sales,” and “It’s noteworthy whether TSMC will disclose the proportion of their 4-nanometer process sales from this year’s first quarter.” Additionally, experts note that Qualcomm and Apple have the highest stakes in TSMC’s 4-nanometer sales.

However, Samsung Electronics aims to mass-produce 2-nanometer semiconductors by 2025 and 1.7-nanometer semiconductors by 2027, planning to triple its production capacity by 2027.

The smaller the nanometer, the thinner the semiconductor circuit linewidth. This thin linewidth allows for higher integration, enabling the creation of better-performing semiconductors in the same area.

In the market up to 4 nanometers, TSMC is dominant. But Samsung’s 3-nanometer is 35% smaller in size than the 5-nanometer, 30% faster, and consumes 45% less power. In contrast, TSMC’s 3-nanometer, set to be released this year, is 13% smaller, 10% faster, and consumes 30% less power.

It remains to be seen whether Samsung can stabilize the yield for its 3-nanometer process, and whether TSMC can successfully produce a proper 3-nanometer semiconductor.

If Samsung’s 3-nanometer semiconductor surpasses TSMC, Samsung’s stock might see a significant increase from its current value.

The Power of Reading 1% #2: The Future of Electric Cars and Batteries

In May 2022, Biden and the US Treasury Secretary Janet Yellen visited South Korea in July. Biden went to Samsung Electronics, while Yellen visited LG Chem, the parent company of LG Energy Solution. This is because the electric vehicle battery market for 2025 has somewhat been determined. It’s anticipated that in two years, LG Energy Solution will surpass the Chinese battery company CATL in the electric vehicle sector, becoming the battery company with the highest global sales.

If this happens, EcoPro, as a material stock, is expected to see improved performance.

Not just lithium-ion batteries, the game changer in the secondary battery market is the solid-state battery. In Japan, Murata is at the forefront of solid-state development and is building factories to start mass-producing solid-state batteries from 2024.

Of course, the technology for solid-state batteries still has a long way to go. However, both Japan’s Murata and Korea’s Samsung SDI are striving to become the game changers of the future. We need to keep an eye on the growth of their solid-state battery technology.

That’s not to say that lithium-ion batteries will disappear. Solid-state batteries are relatively more expensive compared to lithium-ion batteries. Therefore, it’s likely that premium models will use solid-state batteries, while more affordable models will continue using lithium-ion batteries.

Outlook of secondary battery equipment

The Power of Reading 1% #3: A New Meat is Coming (Cultured Meat)

You might have heard about cultured meat in the news at least once. As the population increases, the consumption of meat is expected to decline relatively, leading to the advancement of cultured meat development. It’s like making meat from soy.

Cultured meat can produce meat 20 times faster than raising livestock, and compared to traditional livestock farming, it requires only 1% of the land, 4% of the water, and emits only 4% of the greenhouse gases to obtain the same amount of meat.

However, a problem with cultured meat is that it lacks fat, so it doesn’t taste as rich, and the texture of minced meat in the form of a patty is not as appealing. Additionally, the process to produce cultured meat is slow, and the use of cow’s serum in the culture medium makes it expensive.

The pace of development in cultured meat is accelerating rapidly. The cost has dropped from 250 million won per 100g to just 500 won. By closely examining the impact of cultured meat on the market, we can find future investment opportunities. Related companies include CellMeat, Tae Shin BioPharm, SpaceF, and Seaweed.

From this article, one can infer that it might not be too long before cultured meat becomes a regular item on our dining tables.

The Power of Reading 1% #4: The World Moved by Rare Earth Elements

The most fascinating and helpful information in this book was about rare earth elements. Rare Earth Elements, or REEs, refer to a set of 17 metallic elements that are scarce on Earth. They are mined in places like Brazil and China. Niobium, which comes from Brazil, strengthens iron by about four times.

Rare earth elements have a significant impact on renewable energy sources like solar and wind power. These elements are essential for the advancement of renewable energy technologies. For this reason, the United States has high hopes for space exploration. The surface of the moon is believed to have a rich deposit of rare earth elements.

China, too, has sent unmanned probes to the moon to continuously collect rock samples.

The competition for lunar exploration will eventually turn into a war for rare earth elements.

The reason for venturing into space is not just academic curiosity; it’s driven by economic motivations to gather on the moon.

These rare earth elements also influence motors and robots.

To enhance motor performance, the impact of powerful rare earth elements, including neodymium, is significant. Many of these elements are predominantly found in China.

Deng Xiaoping once said, “The Middle East has oil, but China has rare earth elements.” China is leveraging this to maintain its economic dominance over rare earth elements.

However, the U.S. hasn’t been idle. They found their answer in Greenland, the world’s largest island located between the North Atlantic and the Arctic Ocean. Greenland is rich in numerous rare earth elements like neodymium, praseodymium, dysprosium, and thulium. Additionally, as few people live there, mining processes result in minimal environmental pollution. If the U.S. develops Greenland in response to China’s export bans on rare earth elements, a technological competition between the two countries is anticipated.

Rare earth permanent magnet.

A material that, when magnetized, retains its magnetism even when the external magnetic field is removed.

Permanent magnets have been continuously developed in terms of performance since the invention of KS steel in Japan in 1916. They progressed from Ferrite and AlNiCo, and in the 1960s, the first rare earth magnet, Samarium-Cobalt (Sm2Co17), was developed. In 1983, the Neodymium (Nd2Fe14B) permanent magnet was developed.

Effects of the permanent magnet.

Neodymium permanent magnets are used in a wide range of areas, from consumer electronics like speakers, microphones, and air conditioners to advanced and defense industries, including electric cars and robots.

Among the application fields of permanent magnets, the sectors expected to see the most significant growth in demand are drive motors for electric cars and offshore wind turbines.

(For wind turbines) Motors utilizing permanent magnets play a crucial role in reducing the weight and size of wind turbines, making them especially significant in offshore wind power generation.

(For electric vehicle drive motors) Synchronous motors (PMSM) using permanent magnets have better efficiency compared to motors without them, which is why a significant number of electric car brands are adopting them.

The demand for Neodymium permanent magnets is projected to increase more than six-fold, from 119,000 tons in 2020 to 753,000 tons in 2050. Electric cars and offshore wind installations are driving this growth in demand. The proportion of these two items in the demand for Neodymium permanent magnets is expected to increase rapidly from 20.3% in 2020 to 71.6% in 2050.

OUTRO

I was able to gather a lot of information through the power of reading just 1%. Among those, I looked into the four most promising and representative ones. Rare earth permanent magnets are essential for improving the efficiency of machinery. Continuous attention to these rare earths is necessary. Although South Korea does not produce rare earths, it would be beneficial to look into companies that manufacture and process them.

3 thoughts on “The Power of Reading 1% (Mer)”