Battery man | Is the secondary battery industry in South Korea truly promising?(Denmark Battery man)

There was a battery man from Denmark. In our country, Mr. Park Soon-hyuk, the battery man, is already a sensation. On YouTube and public broadcasts, he shouts in his distinctive and rustic tone, “Buy more when the price goes up!”

I’ve read his book and watched a few of his YouTube videos. Is the K-battery he praises really that good? This question still lingers in my mind.

Meanwhile, I learned about a book by the battery man from Poland. Like Mr. Park Soon-hyuk, he works in the financial sector and has an interest in the battery industry.

Is the K-battery just a ridiculous claim by the Korean battery man? Or is it a good battery as the Polish battery man also suggests?

The book was necessary for a deeper understanding of the K-battery.

However, it doesn’t primarily focus on the Korean battery. In fact, there’s far less content about Korean batteries compared to Chinese batteries. Although the introduction states that “Korea is the country of batteries,” the content of the book merely describes them as competitors “like Japan and Korea, who have already taken the lead.” It mentions, “LG Chem is the hope of the European battery market.”

The Korean battery man says Chinese batteries are no good. He mentions they’re inferior in performance, but that might not be the case.

China entered the battery business “nationally” before South Korea. They have an advantage in mining essential minerals and holding mining rights for batteries.

South Korea might have a technological edge. However, batteries are not only made with technology. The combination of “diplomacy + resources + technology” is what constitutes secondary batteries.

How did China’s battery industry manage to develop?

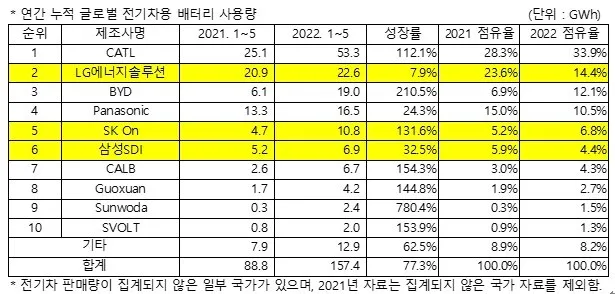

After the sweeping rise of EcoPro’s stock in late 2023, one might think the South Korean battery market is at its peak. That’s not exactly true. It might sell well in the future, but currently, Chinese battery companies hold a higher market share.

It was surprising. It was my subjective judgment to underestimate China’s technological prowess. But a country “like” China leading in electronic product production? Not from Japan, like Panasonic, but from China?

Why did they become number one?

China has many talented individuals. Since 1986, Chinese scientists sent letters to Deng Xiaoping. They argued not to disperse efforts for the development of Chinese science and technology. They asserted that science and technology should be developed nationally. Due to these efforts, electric vehicles began to evolve as a key sector from 2001.

The development initiated in 2001 continues to be included in the ‘Made in China 2025’ strategy announced in 2017.

Made in China 2025

‘Made in China 2025’ is a policy first announced by Premier Li Keqiang at the National People’s Congress in 2015. It’s an industrial strategy aiming to shift China’s economic model from ‘quantitative growth’ to ‘qualitative growth’ through the foundation of manufacturing, technological innovation, and green growth.

- They aim to achieve a 70% domestic production rate for key components and materials by 2025.

- Their goal is to elevate ten core industries to the world’s best standard.

- The ten core industries are: next-generation IT, robots, aerospace, marine engineering, high-speed rail, high-efficiency & new energy vehicles, environmentally friendly power, agricultural machinery, new materials, and bio.

It was their effort to move beyond the ‘Made in China’ image and transform into a nation producing qualitatively superior products.

Through this movement, China pushes for the expansion of electric vehicles within its borders. It’s a “10 cities, 1000 electric vehicles” campaign. Of course, it wasn’t 100% successful. However, they achieved half of their goal.

In this way, by promoting electric vehicles domestically, they created their market. Currently, companies like BYD (Build Your Dream) and CATL are leading in battery market share.

The national inception of China’s battery industry started on a larger scale than South Korea. And it evolved through their vast domestic market.

Lithium is essential. Where do Chinese companies obtain lithium?

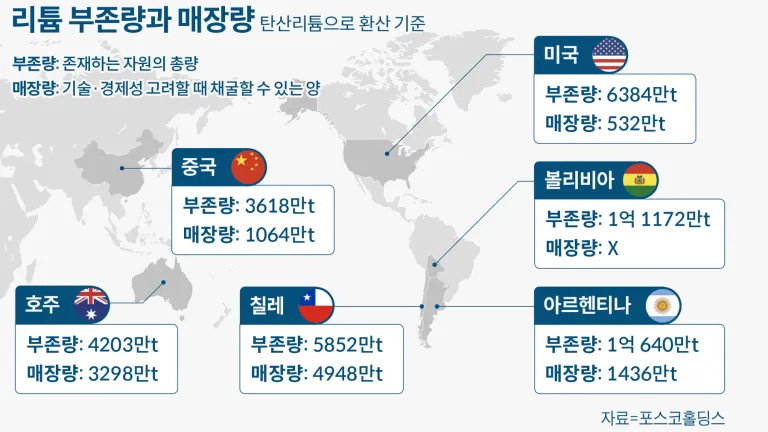

Lithium is the third element on the periodic table. It has the strongest reactivity while having the lowest density. Due to these characteristics, it is an essential material in all types of batteries. About 5 grams of lithium are used in mobile phones, and 30-60kg are used in electric cars. Therefore, the price of lithium affects the price of batteries, and the price of batteries influences the price of electric cars. This, in turn, affects consumer sentiment. Ultimately, companies that can mine lithium stably and produce batteries have a higher potential for growth.

China has excellent geographical conditions. After Australia and Chile, China has the third-largest lithium reserves in the world. So, it seems that China would have an advantage in lithium mining. However, domestic lithium in China suffers from development technology inadequacies and high impurity levels in lithium resources. Therefore, China secures lithium through equity investments in countries like Australia, Chile, and Argentina.

South Korea’s lithium import conditions are not favorable. The Korean peninsula doesn’t have lithium reserves. It’s far from natural minerals. Therefore, it relies entirely on imports. This can potentially affect price stability. South Korean battery companies import about 65% of their lithium from China and 31% from Chile.

In the US, through the Inflation Reduction Act (IRA), there is an intensified economic exclusion of non-aligned countries. China will not remain passive. Under these circumstances, South Korea’s heavy reliance on China for most of its lithium imports could become problematic. There’s uncertainty about when China might halt exports.

POSCO Holdings acquired the Ombre Muerto salt flat in Argentina and has been mining more than expected, generating anticipation. Such proactive efforts are necessary for securing lithium.

China is also reliant on overseas imports for lithium, making its relationship with Australia particularly important. However, due to the IRA, South Korean companies are strengthening their cooperation with countries like Australia and Chile, which have signed FTAs with the United States.

While China has lithium deposits within its territory, South Korea does not. Even though China imports lithium, South Korea is entirely dependent on imports. For long-term growth, South Korean companies must continue their efforts to secure lithium resources.

Is lithium the only important mineral? Aren’t other minerals important as well?

In addition to lithium, there is another important mineral called cobalt. Cobalt plays a role in enhancing safety in materials. As mentioned above, lithium is mined in various countries around the world. However, 60% of the world’s cobalt comes from Congo.

China has a favorable trading position regarding the precious cobalt from Congo. Currently, 98% of the cobalt consumed in China is imported from Congo.

How did China achieve this? The story of the president of Congo needs to be told. Joseph Kabila, who inherited the regime of Congo in 2006, was a young president in his 30s. He studied at the National Defense University of the People’s Liberation Army in China. Naturally, he would have had positive feelings towards China due to their special care for him.

China’s diplomatic efforts came back in the form of cobalt. Congo traded with China by granting mineral mining rights in exchange for infrastructure investment in their country. From China’s perspective, it was a successful deal.

Cobalt is also in favorable conditions for Chinese companies. The battery business is not just about “resources + technology” but about “diplomacy + resources + technology.” It’s not possible for one country to produce batteries alone. Countries rich in minerals typically lack technological prowess. They will trade with countries that have better technology using their minerals. South Korea also needs such proactive diplomacy.

Battery recycling is essential.

We have identified that batteries contain precious metals. We cannot simply bury such batteries underground. Recycling the minerals inside batteries can reduce our dependency on foreign imports.

Especially for countries like South Korea, which lack natural resources, this aspect is crucial. Japanese company JX Metals and Chinese company GEM Co. Ltd. started battery recycling businesses early on. GEM Co. Ltd. has the capacity to process up to 300,000 tons of waste batteries annually. In China, in 2020, 500,000 tons of lithium-ion batteries were discarded.

Could electric airplanes be a possibility?

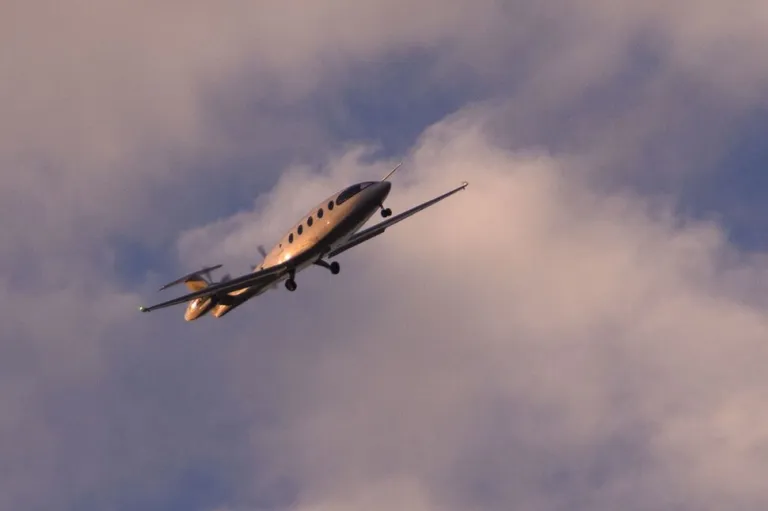

Electric airplanes have already emerged. One has even successfully test-flown for 8 minutes.

It’s a model called “Alice” from Israeli company, Eviation. Often referred to as the “Tesla of the aviation world,” it began development a long time ago and has successfully completed test flights. Airlines such as DHL and Cape Air have even made pre-orders. It’s a quiet and eco-friendly airplane, which could potentially be highly utilized for domestic flights and cargo routes.

Recommended Reads on the Website

Principles of secondary battery and anode materials

High-nickel anode material and Ultra high-nickel anode material’s Justice and outlook