“Future Investment Outlook ” Intro

Future Investment Outlook. Writing on a Somewhat Abstract Topic.

In 2023, despite the overall weakness in the South Korean stock market, there was a strong trend in the secondary battery sector. Alongside the frenzy around Mr. Park Soon-hyuk (the Battery Guru), secondary battery material stocks led the way in the first half of 2023. Subsequently, the market shifted its focus to equipment stocks as recommendations from senior investors.

Those who started investing upon hearing about the promising stocks must have reaped substantial profits. However, those who had the foresight and invested two years ago likely enjoyed even greater gains

Recently, I read a book where an economics/stock YouTuber predicted the future of secondary batteries. They claimed that the content in their book from two years ago had this information. Although I haven’t read the book myself, I’ll trust it for now.

What I’m curious about is how people can discover promising stocks 2-3 years in advance. From there, my thoughts expanded to the idea of ‘the future.’ I started searching for books on future investment outlooks.

Through this, I believe we can gain insights into future investment prospects. Being prepared ahead of others might provide excellent opportunities.

The first step in this direction is the book ‘2040 Future Predictions.’ The author is Makoto Naruke, a former CEO of Microsoft Japan. While there are occasional references to Japan-specific content like earthquakes and Mount Fuji eruptions, I’ll focus on the key technological insights from the book.

After reading the book, it is structured around four key future investment outlook themes:

- Beyond 5G into the 6G Era.

- Autonomous Vehicles.

- Urban Air Mobility (UAM).

- Secondary Batteries (Solid-State Batteries)

Author : Naruke Makoto

Born in Hokkaido, Japan, in 1955, he graduated from the Faculty of Commerce at Juso University. He went on to work at companies such as ASCII, an automobile parts manufacturing company, before joining Microsoft (Japanese branch) in 1986. In 1991, he assumed the role of CEO and President of Microsoft. After leaving the company in 2000, he founded an investment consulting firm called Inspire. He also served as an outside director at Suruga Bank and a visiting professor at Waseda University’s business school. Currently, he is also the CEO of the book review site Honz.

Future Investment Outlook 1. Beyond 5G into the 6G Era (Another Information and Communication Revolution)

It is expected that by 2030, the 6th generation mobile communication system, ‘6G,’ will have been commercialized. When 6G becomes practical, a two-hour-long movie that used to take about 5 minutes to download will be downloaded in less than 0.5 seconds, literally in the blink of an eye.

Commercialization is expected to begin in 2030, and by 2040, there is a high likelihood that everyone will be using 6G services. It is expected to be approximately 10 to 100 times faster than the current 5G speed we are using.

However, it’s not just the download speed of smartphones and the internet that will become faster. The speed of the Internet of Things (IoT), which is currently advancing, will also increase. Everything around us will have computer-level processing capabilities.

The world is becoming a place where everything turns into computers. How will things change?

True autonomous driving will become possible. Buses, trains, trucks, and more will be connected to networks, allowing for genuine autonomous driving. This will lead to increased efficiency not only in public transportation but also in logistics.

Augmented reality glasses will project all information. There will be no need to look at a smartphone map while heading to your destination. By simply wearing these glasses, you will receive all the necessary information without the need for a map application.

“So, where might we find promising companies for future investment in the 6G era?”

KMW (South Korea): This company is engaged in the manufacturing and sale of wireless communication devices, application devices (RF switches, RF filters), mobile communication components, communication relay equipment, and the development and supply of modules for communication base stations. Their main products include GaN transistors and GaN power amplifiers, accounting for more than 90% of the company’s total revenue.

RFHIC (South Korea): RFHIC manufactures communication equipment, broadcasting equipment, radar systems, wireless devices for navigation, and surveying instruments. Their primary products include GaN transistors and GaN power amplifiers, which make up more than 90% of their total revenue.

에이스테크 (Ace Technologies, South Korea): Ace Technologies specializes in the mobile network equipment industry, producing base station antennas, RF equipment for base stations, mobile device antennas, and RF connectors. In the defense industry sector, they have been involved as a development partner in areas such as radar, guided weapon systems, command and control communication systems, satellite communication, and data links since 2008.

Verizon (USA), AT&T (USA): These are the largest telecommunications companies in the United States, consistently generating substantial revenue and profits. They are well-positioned to provide communication services to existing subscribers even as the transition to 6G takes place.

NVIDIA (USA): NVIDIA, renowned for its AI semiconductor technology, is engaged in providing AI services utilizing 5G. Such platforms are expected to naturally transition into the 6G era.

“NVIDIA AI-on-5G is a unified platform that integrates AI and 5G advancements at the edge, accelerating the digital transformation of companies across all industries. 5G provides the foundational connectivity for hundreds of millions of devices, expanding the influence of AI algorithms and applications to all objects connected at the edge, enabling new use cases and markets.” (Company introduction related to AI-on-5G)

Future Investment Outlook 2. Autonomous Vehicles

Autonomous vehicles are not a distant future concept; they are already a technology present in our lives. Autonomous driving technology is categorized into levels ranging from Level 0 to Level 6.

- Level 0 involves manual driving by a human.

- Level 3 allows for system control in specific locations like highways, with the option for emergency human intervention (similar to current semi-autonomous features).

Level 4 is the stage we envision for fully autonomous vehicles in the distant future. It involves the system handling most driving tasks, including emergency situations, on the majority of roads.

It is expected that by 2040, over 30% of the vehicles released will be at Level 3 or higher in terms of autonomous driving capability. By 2030, Level 4 autonomy is expected to be widespread. With the technological advancements in 6G communication, we can anticipate experiencing autonomous vehicles within the next decade

What are the stocks related to autonomous vehicles (future investment outlook)?

Motrecs (South Korea) Motrecs, established in October 2001, is an automotive parts manufacturing company. Leveraging Automotive HMI technology, it produces and sells IVI (In Vehicle Infotainment) products. Motrecs is gaining significant attention as a company that develops and manufactures HUD, ADAS, and other autonomous vehicle-related technologies.

Mobile Appliance (South Korea) Founded in April 2004, Mobile Appliance specializes in research, development, and production of autonomous driving and smart car products and solutions. They have developed ADAS (Advanced Driver Assistance Systems) using deep learning-based image recognition technology, a critical component for autonomous driving vehicles. Additionally, Mobile Appliance produces smart car-related products such as SVM (Surround View Monitor) and HUD (Head-Up Display).

ON Semiconductor (USA) Automotive Sensors and Cameras: ON Semiconductor develops and provides various sensor and camera technologies used in automobiles. These technologies are essential components of autonomous driving systems, aiding in environmental sensing and driving decision-making. LiDAR (Light Detection and Ranging) Technology: LiDAR is a technology used for scanning and recognizing the driving environment with high precision. ON Semiconductor develops semiconductor solutions related to LiDAR sensors, contributing to the safety of autonomous vehicles. ADAS (Advanced Driver Assistance Systems): ON Semiconductor offers semiconductor products supporting ADAS technology, enhancing driver assistance and safety features. Power Management Solutions: Autonomous vehicles require a significant amount of power, and ON Semiconductor develops solutions for power supply and management in automobiles, improving efficiency and extending battery life. ON Semiconductor develops and provides various semiconductor products connected to autonomous driving technology in the automotive industry, contributing to improving the autonomous driving capabilities and safety of vehicles.

Intel (USA) Mobileye: A subsidiary of Intel, Mobileye plays a crucial role in autonomous driving systems. Mobileye develops driving assistance systems based on camera and sensor technology, enhancing driving safety and improving the visual recognition capabilities of autonomous vehicles. Automotive Sensors and Computing: Intel develops and provides sensor technology and computing power required for autonomous vehicles. This allows vehicles to perceive their environment and make driving decisions. ADAS (Advanced Driver Assistance Systems): Intel offers semiconductor solutions and computing platforms to support ADAS technology, enhancing driver assistance and safety functions. Autonomous Driving Vehicle Simulation: Intel develops autonomous driving vehicle simulation technology to test and improve autonomous algorithms. Industry Collaboration: Intel collaborates with various partners in the autonomous driving field, contributing to the advancement of autonomous driving technology and standardization.

NVIDIA (USA) NVIDIA DRIVE Platform: NVIDIA is developing the comprehensive “NVIDIA DRIVE” platform for autonomous vehicles. This platform is used by car manufacturers and autonomous technology developers to design and build autonomous driving systems. NVIDIA GPUs: NVIDIA accelerates sensor data processing and machine learning algorithm execution in autonomous vehicles using high-performance graphics processing units (GPUs). These GPUs play a crucial role in meeting the sensor data processing and computing requirements of autonomous vehicles. Automated Driving Systems: NVIDIA DRIVE is used to develop automated driving systems that help vehicles perceive their environment and make driving decisions. These systems include driving assistance features, automated parking, lane-keeping, and adaptive cruise control. AI (Artificial Intelligence) and Computer Vision: NVIDIA applies AI and computer vision technology to autonomous vehicles, enabling them to recognize the driving environment and drive safely. Industry Collaboration: NVIDIA collaborates with automotive manufacturers, tech companies, and research institutions in the field of autonomous driving, contributing to the development of autonomous driving technology and standardization.

Tesla (USA) Autopilot: Tesla’s driving assistance system, “Autopilot,” offers automated driving features such as lane-keeping, maintaining a safe following distance, and automatic lane changes. Current Autopilot requires driver attention, and fully autonomous driving has not yet been commercialized. Full Self-Driving (FSD): Tesla offers the Full Self-Driving (FSD) option, which aims to provide full autonomous driving capabilities to vehicles. FSD is continuously updated, allowing vehicles to perceive their environment and make driving decisions. Machine Learning Network: Tesla uses deep learning and artificial intelligence (AI) machine learning networks for the development and improvement of autonomous driving features. Vehicles collect data and use it to enhance driving scenarios. Various Sensors: Tesla vehicles use a variety of sensors, including radar, ultrasonic sensors, and cameras, to detect their surroundings and perform environmental perception. Software Updates: Tesla continually improves and expands autonomous driving features through software updates that can be performed remotely, allowing owners to access the latest capabilities. Regulation and Safety: Companies developing autonomous driving technologies like Tesla must consider regulatory and safety issues, and work in this area is ongoing.

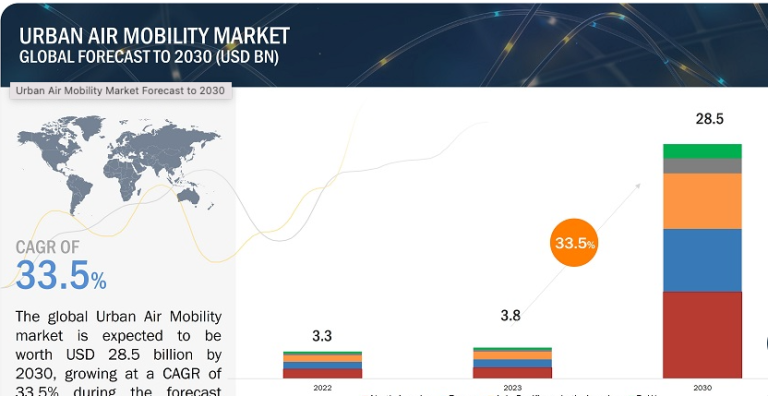

Future Investment Outlook 3. UAM

It may sound like a dream, but global companies like Uber Technologies, Boeing, Airbus, and others are already diving into the development of flying cars. Morgan Stanley predicts that the market size of flying cars will grow to $1.5 trillion by 2040, accounting for 1.2% of the world’s total Gross Domestic Product (GDP).

However, even if it is technically feasible, a rapid transformation is not easy. This is due to regulatory and cost issues. Just like when automobiles were first introduced, there were numerous obstacles to overcome. UAM (Urban Air Mobility) also needs to address safety and traffic regulations.

To paint a brighter future outlook for UAM investments, the following issues must be addressed:

Firstly, overcoming technological challenges such as batteries, autonomous flight, noise, cost-effectiveness, and integration of ground and air transportation.

Secondly, the establishment of new policies and regulations, including safety standards and certification methods.

Thirdly, the development of a new air traffic management system.

Fourthly, the construction of necessary infrastructure such as vertical landing pads (vertiports) and charging stations.

What are the stocks related to UAM (Urban Air Mobility)?

FiberPro (Korea) FiberPro is a company that develops optical fiber inertial sensors and is recognized for its technological expertise in the fields of aviation, aerospace, robotics, autonomous driving, and artificial intelligence. It has also been invited to participate in the UAM (Urban Air Mobility) consortium, which is considered the future mode of urban transportation.

FiberPro has seen a significant increase in its stock price this year, rising by more than 129% from June to December 2022. As of June 29th, its stock price reached the upper limit at 5,100 won. This surge is attributed to its strength as a related stock to UAM (Urban Air Mobility).

Gisantelcom (Korea) Gisantelcom primarily engages in the manufacturing and sale of communication equipment. In April 2023, the company absorbed its subsidiary, Hyundai J-Com, and entered the defense industry sector.

Gisantelcom is known as a related stock to UAM (Urban Air Mobility), and its subsidiary, Mofiance, is recognized as the only domestic developer of DVOR equipment related to aviation navigation safety.

Vessel Aerospace (Korea) Vessel Aerospace is a company that, based on its experience and technology in successfully mass-producing the two-seat light aircraft KLA-100, aims to become a key player in the K-UAM era as an Air Mobility Solution Provider.

AirBus (USA) Concept: Airbus UAM is a concept that uses unmanned aircraft for urban transportation. These aircraft have vertical takeoff and landing (VTOL) capabilities and are designed to address urban traffic congestion and provide a fast mode of transportation. Unmanned Aircraft: Airbus UAM includes unmanned aircraft powered by electricity or hybrid power. These aircraft transport passengers and cargo, operating safely through automated flight systems. Urban Mobility Innovation: Airbus UAM aims to revolutionize urban transportation, solve complex traffic congestion issues, and provide environmentally friendly transportation methods. Technology Development: Airbus is committed to developing UAM technology through various research and development efforts, including the development and testing of unmanned aircraft. Collaboration: Airbus collaborates with various partners to realize urban air mobility, including cooperation with governments, companies, and research institutions.

Joby Aviation (USA) Company Overview: Joby Aviation is a US-based aviation company that plays a significant role in the development and manufacturing of electric vertical takeoff and landing (eVTOL) aircraft. eVTOL Technology: Joby Aviation is developing environmentally friendly eVTOL aircraft with vertical takeoff and landing capabilities to address urban traffic congestion and provide fast transportation. Operations in Urban Spaces: Joby Aviation plans to operate unmanned aircraft in urban spaces to improve urban mobility using autonomous driving and UAM technology. This aims to reduce traffic congestion and minimize environmental impact. Flight Testing: Joby Aviation is conducting flight tests of its self-developed eVTOL aircraft, focusing on ensuring safe and efficient operation. Collaboration: Joby Aviation collaborates with various partners to realize UAM in urban spaces and contributes to regulations and infrastructure development through cooperation with governments.

Lilium (USA) Company Overview: Lilium is a German aviation company headquartered in Munich, focusing on developing innovative eVTOL aircraft technology. These aircraft have vertical takeoff and landing capabilities and are designed to provide safe and efficient urban mobility. eVTOL Technology: Lilium’s eVTOL aircraft are powered by electricity, emphasizing sustainability and environmental friendliness. They operate using rechargeable batteries, ensuring flight time and offering a clean mode of transportation. Unmanned Aircraft and Automation: Lilium places significant importance on automation and unmanned flight technology. They are developing autonomous capabilities for passenger and cargo transport. Utilization in Urban Spaces: Lilium aims to improve urban mobility by realizing UAM in urban areas. This effort intends to alleviate urban traffic congestion and provide a faster and more efficient mode of transportation. Flight Testing: Lilium conducts flight tests of its self-developed eVTOL aircraft, adhering to strict quality and safety standards for safe operation.

Future Investment Outlook 4. Secondary Batteries (Solid-State Batteries)

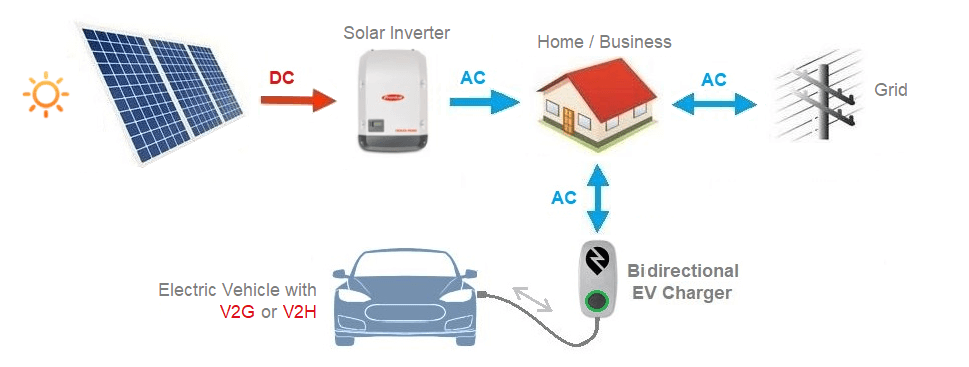

The development of secondary batteries is an ongoing process. However, the future direction of secondary batteries is solid-state batteries. Currently, lithium-ion batteries have seen significant advancements. Nevertheless, if lithium-ion batteries in electric vehicles are replaced with solid-state batteries, it could lead to a complete transformation in energy storage and the environment. This is because electric vehicles could be used as energy storage facilities.

With the development of solid-state batteries, it is expected that a single charge could provide a driving range of approximately 700-800 kilometers. Additionally, there is the potential for significant changes through Vehicle-to-Grid (V2G) technology, which connects electric cars to the power grid.

What are the stocks related to Solid-state Batteries?

Samsung SDI (Korea): Samsung SDI is developing battery technology that utilizes advanced environmental energy as the demand for electric vehicles continues to increase. In particular, solid-state batteries are products referred to as “dream batteries” due to their high energy density and lack of fire hazard. Samsung SDI has developed its own solid electrolyte and completed the construction of a solid-state battery pilot line, aiming to start production of prototypes in the second half of the year.

Solid Power (USA): Solid-State Battery Technology: Solid-state batteries use solid electrolytes that provide higher energy density and stability compared to traditional lithium-ion batteries. This technology is expected to enhance battery safety, charging speed, and energy storage capacity, playing a crucial role in electric vehicles and mobility solutions. Solid Electrolyte: Solid Power is developing solid electrolyte technology, which offers higher stability and safety compared to liquid electrolytes used in traditional batteries. This minimizes issues like fires and explosions while extending battery lifespan. High Performance and Longevity: Solid Power’s solid-state batteries deliver high performance and have a longer lifespan, supporting extended driving ranges and usage times. Automotive and Mobility Applications: Solid Power primarily focuses on developing battery solutions for mobility applications such as electric vehicles and drones. Solid-state batteries can improve the performance of electric vehicles, shorten charging times, and enhance safety through collaboration with automobile manufacturers. Collaboration and Investment: Solid Power collaborates with various companies to advance its technology development and receives investments to support its research efforts.

QuantumScape (USA): Solid Electrolyte Technology: QuantumScape’s key technology involves using solid-state electrolytes, which offer significantly higher stability compared to traditional liquid electrolytes, reducing safety concerns like fires and explosions. High Energy Density: QuantumScape’s solid-state electrolyte technology provides a high energy density, enhancing battery energy storage capacity. This enables longer driving ranges in applications like electric vehicles. Charging Speed: QuantumScape claims that its use of solid-state electrolytes can greatly improve battery charging speed. This can reduce electric vehicle charging times and enhance user convenience. Automotive Applications: QuantumScape aims to apply solid-state battery technology to automotive applications, including electric and hybrid vehicles. Improving safety, performance, and charging speed is crucial in such applications. Collaboration: QuantumScape has partnered with the Volkswagen Group to develop solid-state battery technology and is working toward commercialization through this collaboration.

Recommended Reads on the Website

High-nickel anode material and Ultra high-nickel anode material’s Justice and outlook